When President Joe Biden recently visited Wisconsin, he announced a new student loan debt cancellation plan benefitting over 30 million American borrowers.

“First, my administration will propose a new rule to cancel up to $20,000 in runaway interest for any borrower who owes more now than when they started paying the loan. And for low and middle-class families enrolled in my SAVE program, we’ll cancel all of your interest. And second, we plan to cancel student debt for borrowers who still owe student loans even though they started repaying them more than two decades ago,” President Biden said, citing five major intended actions.

He added that there is a plan to cancel debt for about two million borrowers who would be eligible for debt forgiveness through the SAVE Program, Public Loan Service Forgiveness, or other debt cancelling programs, but who are not enrolled in these programs. Additionally, there is a plan to cancel debt for borrowers who the Department of Education determines were “cheated” by universities that left students with unaffordable loans but delivered little benefit.

“And finally, the Department of Education will propose a new rule that will cancel student loan debt for Americans facing financial hardships. And over the coming months, the Department of Education will propose and then implement these plans,” President Biden said. “Starting this fall, we plan to deliver up to $20,000 in interest relief to over 20 million borrowers and full forgiveness for millions more.

Jon Donenberg, Deputy Director at National Economic Council at The White House coordinates economic policy matters across the administration, including student loans. He told The Baltimore Times that President Biden’s new plan dates to his original plan to relieve student loan debt and the U.S. Supreme Court’s evaluation of it.

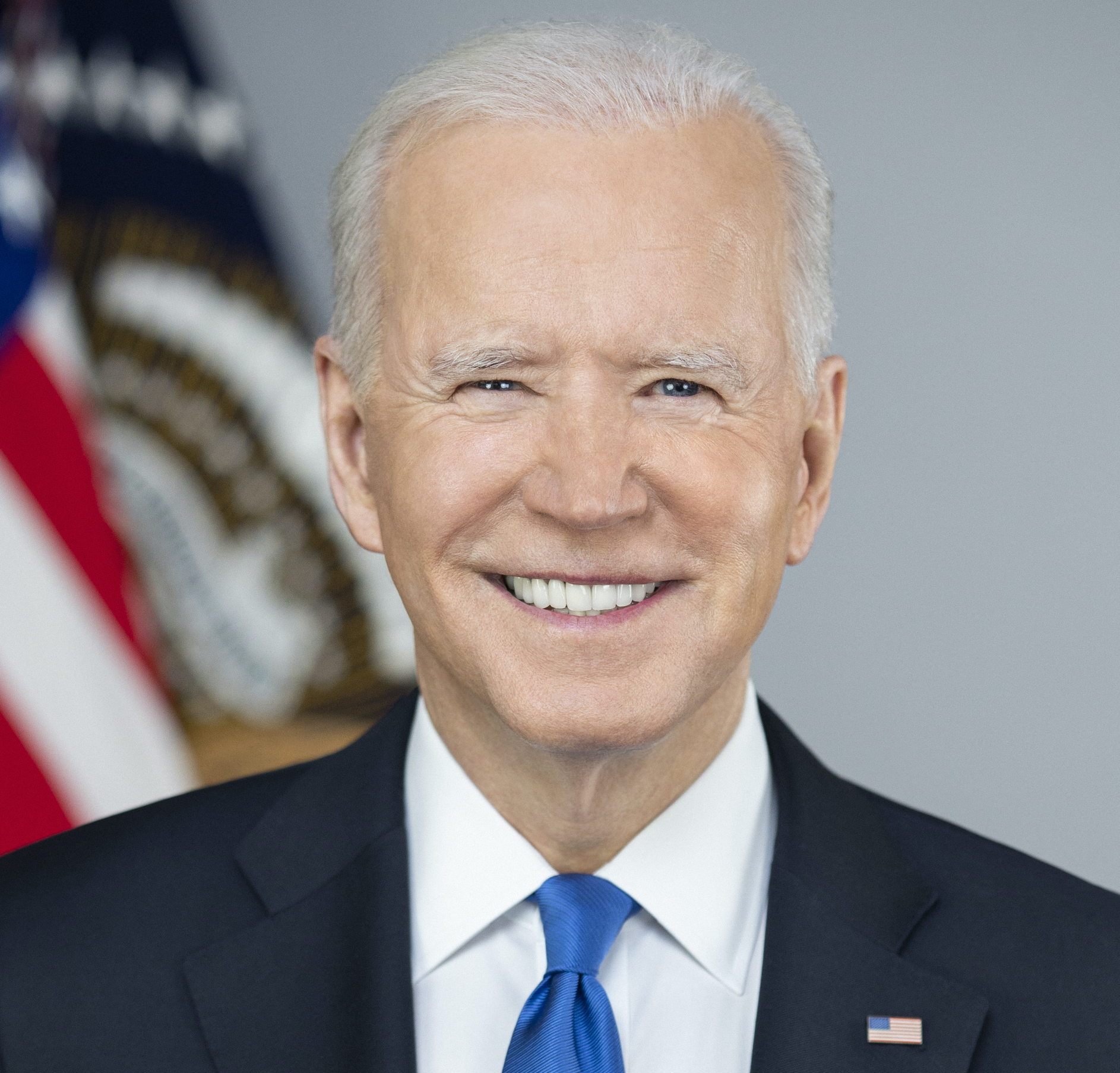

Photo credit: White House Photo Office

The high court bluntly rejected a plan that would have discharged up to $20,000 in student loans for low-income Pell Grant recipients and $10,000 of relief to remaining federal student loan borrowers.

“My Administration’s student debt relief plan would have been the lifeline tens of millions of hard- working Americans needed as they try to recover from a once-in-a-century pandemic. Nearly 90 percent of the relief from our plan would have gone to borrowers making less than $75,000 a year, and none of it would have gone to people making more than $125,000. It would have been life-changing for millions of Americans and their families. And it would have been good for economic growth, both in the short- and long-term,” President Biden also said in 2023.

“The Department of Education is pursuing alternative paths to debt relief under the Higher Education Act (HEA),” Donenberg explained.

The original HEA https://www.law.cornell.edu/uscode/text/20/1082 , created in 1965, established federal aid programs to provide financial assistance for students to help students pay for college. It contains a provision allowing the Secretary of Education to “compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

Donenberg further stated debt loan debt relief has already been provided to four million Americans during Biden’s administration.

“We’re going to continue on our pre-existing efforts, but these new rules are going to help us reach over 30 million Americans. Our plan is to release those rules over the coming months and to work to implement them as quickly as possible,” he said.

Borrowers who are not yet enrolled in the SAVE Plan are also encouraged to consider applying for it. Donenberg stated enrolled borrowers only pay 5% of their monthly disposable income after required expenses are taken out.

“If you stay in the program for a period of time, eventually your remaining loan balance will be wiped out at the end. There’s a similar program for public service workers in particular, our teachers, our firefighters. Folks that serve the community,” Donenberg explained.

He added, “We know there are 43 million Americans in this country who have student debt right now. And we know that many of those individuals could be eligible for relief under the law, but either the Department has to finish writing those regulations, or we need to make sure we can keep people enrolled in the programs that exist.”

During an April 9, 2024 White House Briefing on Student Debt Relief, it was mentioned that if finalized as proposed, student debt relief would be canceled for borrowers who first entered repayment 20 or more years ago. The aim is that much loan forgiveness would be done automatically, not requiring an application.

Learn more about student loan debt relief proposals and programs by visiting www.StudentAid.gov/debtrelief.